Providing these paperwork is part of a verification step wanted to comply with UK laws designed to cease fraud, cash laundering and unlawful https://kalinina35.ru/2025/03/15/company-registration-within-the-uae-free-zone/ account use. It helps hold accounts and prospects protected – but it’s not at all times straightforward to supply this paperwork as a non-resident or new arrival in the UK. For a full-service financial institution with the choice of bodily branches that still offer a great online expertise, the high road names are a secure wager. Barclays, HSBC, Lloyds and NatWest all let you apply online and offer a broad vary of products.

- No, you want a permanent UK handle to open a checking account in the UK.

- For an HSBC Expat account you may find a way to apply online should you meet sure eligibility standards – examine the details fastidiously before you start your application.

- Banks within the UK can refuse to open an account for someone on numerous completely different grounds, the most common ones being failed credit checks or not providing sufficient ID or proof of address.

- However if you’ve simply landed, you in all probability don’t—and that’s completely normal.

- These accounts open doors rapidly, and when you get your first digital bank statement, you can use it as proof for more conventional banks later.

Basic Bank Accounts

This is a lifesaver for newcomers who don’t but have traditional Proof Of Address Paperwork like council tax payments or utility letters. If you frequently ship cash residence, receives a commission in international foreign money, or must make International Cash Transfers, a daily British Financial Institution might limit your flexibility. This is where worldwide and multi-currency accounts can make List of diplomatic missions of the United Arab Emirates life much easier for model spanking new residents.

Looking for more tips to assist settle in smoothly, together with tips on how to cope with direct debits or arrange online banking? You’ll find useful steps in the Thrive in the UK blog, with recommendation picked up from real-life experiences. If sorting paperwork feels like %KEYWORD_VAR% a barrier, starting with Monzo, Starling, or Clever is a great move. They get you banking within the UK fast, and their statements are accepted by traditional banks when you want to upgrade later. You’ll find more recommendations on forms of accounts, credit unions, and tips on how to avoid charges as a newcomer in our useful transferring to the UK with no job information.

Ship Money Across Borders!

Banks are required by legislation to verify your identity to comply with anti-money laundering rules. If you are unsure about any info requested, ask the financial institution for clarification quite than guessing or making assumptions. Banks must explain why they want your information, how it will be used, and how lengthy it will be saved. They can not share your information with different organisations without your consent, except required by regulation (for instance, for fraud prevention or anti-money laundering checks). You also have the best to access the information a bank holds about you and to ask for it to be corrected if it is inaccurate. Banks acquire personal info if you apply for an account, similar to your name, tackle, date of birth, and proof of id.

However, within the UK, banks actually run a credit examine when opening financial institution accounts. If you are opening a savings account apart from an prompt savings account, you will be given less detailed info than for other types of account. It may be offered in a abstract box which is able to assist you to examine completely different accounts from different banks and building societies. Some present accounts can also earn you interest on the money you have in the account, although this is likely to be lower than many savings accounts.

Hsbc Expat

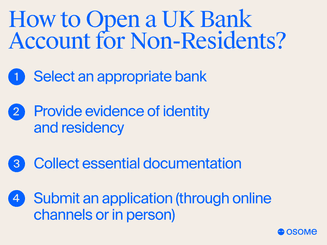

You will normally want a UK handle when applying except you already bank with an international provider that has UK protection. Banks usually require you to fill out an software form and undergo a credit score examine (unless opening a fundamental account) when applying. You might need to prove your identity and your handle to be able to open a checking account https://execdubai.com/ within the UK.

Switching Present Accounts – What You Have To Do

We update our knowledge frequently, but data can change between updates. Confirm details with the provider you are excited about earlier than making a decision. Depending on the bank, you could be requested safety questions, or for a short video selfie as a half of digital ID checks. For a full rundown of factors that shape your credit—for better or worse—see Experian’s clear guide on what impacts your credit score score.